All Categories

Featured

Table of Contents

- – Unmatched Accredited Investor High Return Inve...

- – Preferred Accredited Investor Real Estate Inve...

- – Optimized High Yield Investment Opportunities...

- – All-In-One Accredited Investor Passive Income...

- – Unparalleled Accredited Investor Syndication...

- – Specialist Investment Platforms For Accredit...

- – Superior Private Equity For Accredited Inves...

The laws for certified investors vary among territories. In the U.S, the definition of a recognized investor is presented by the SEC in Regulation 501 of Guideline D. To be an accredited capitalist, an individual must have an annual revenue exceeding $200,000 ($300,000 for joint earnings) for the last two years with the expectation of earning the exact same or a higher revenue in the present year.

An accredited capitalist ought to have a total assets going beyond $1 million, either individually or collectively with a partner. This quantity can not include a primary house. The SEC likewise thinks about candidates to be recognized financiers if they are general companions, executive officers, or directors of a business that is releasing non listed safeties.

Unmatched Accredited Investor High Return Investments

Likewise, if an entity includes equity owners who are approved financiers, the entity itself is a certified financier. A company can not be developed with the single objective of acquiring certain safeties. A person can certify as an approved capitalist by showing adequate education or job experience in the financial industry

Individuals who want to be certified financiers don't apply to the SEC for the classification. Rather, it is the obligation of the company offering a private placement to make sure that every one of those approached are accredited investors. People or parties that intend to be accredited capitalists can come close to the company of the unregistered safeties.

For example, expect there is a private whose earnings was $150,000 for the last three years. They reported a main home value of $1 million (with a home mortgage of $200,000), an auto worth $100,000 (with an outstanding finance of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Web well worth is calculated as possessions minus responsibilities. This individual's net worth is exactly $1 million. This includes an estimation of their possessions (aside from their main house) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan amounting to $50,000. Since they satisfy the net worth need, they qualify to be a recognized investor.

Preferred Accredited Investor Real Estate Investment Networks with Accredited Investor Returns

There are a couple of less common qualifications, such as taking care of a trust with greater than $5 million in properties. Under government securities laws, only those that are accredited financiers might join certain safeties offerings. These might consist of shares in personal positionings, structured items, and personal equity or bush funds, to name a few.

The regulatory authorities wish to be certain that participants in these extremely risky and complicated financial investments can look after themselves and evaluate the risks in the absence of federal government protection. The certified investor rules are developed to shield prospective investors with restricted economic expertise from adventures and losses they may be unwell equipped to hold up against.

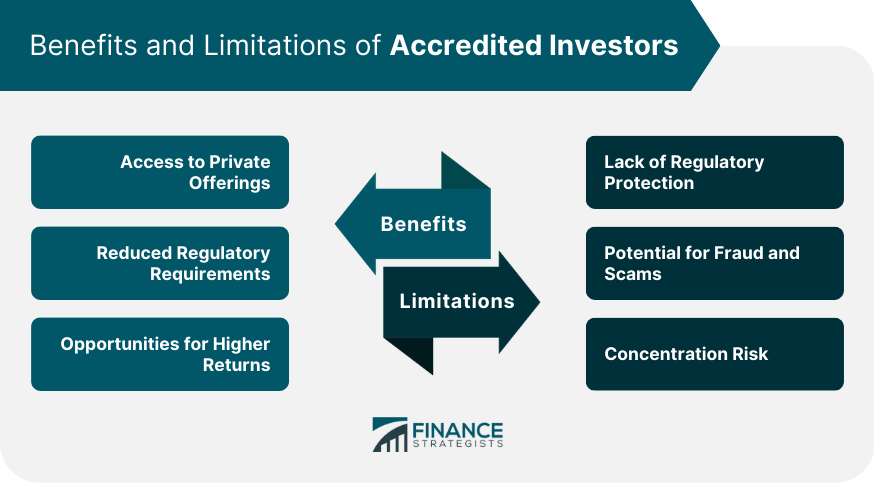

Certified capitalists satisfy qualifications and specialist standards to gain access to unique financial investment opportunities. Designated by the United State Securities and Exchange Payment (SEC), they acquire access to high-return options such as hedge funds, financial backing, and private equity. These investments bypass complete SEC registration however carry greater risks. Certified investors need to meet earnings and total assets needs, unlike non-accredited people, and can invest without restrictions.

Optimized High Yield Investment Opportunities For Accredited Investors for Accredited Investment Results

Some crucial adjustments made in 2020 by the SEC consist of:. This change acknowledges that these entity types are usually utilized for making financial investments.

This modification make up the results of rising cost of living gradually. These modifications expand the accredited financier swimming pool by around 64 million Americans. This wider access offers a lot more opportunities for capitalists, however additionally boosts possible threats as less financially sophisticated, capitalists can participate. Organizations making use of private offerings may gain from a larger pool of possible financiers.

One significant benefit is the chance to invest in positionings and hedge funds. These financial investment options are special to certified capitalists and organizations that certify as a recognized, per SEC policies. Private placements make it possible for business to protect funds without navigating the IPO treatment and regulative documents required for offerings. This offers recognized financiers the possibility to purchase emerging business at a stage prior to they think about going public.

All-In-One Accredited Investor Passive Income Programs

They are deemed investments and are easily accessible only, to qualified clients. In enhancement to known companies, qualified capitalists can pick to purchase start-ups and promising ventures. This provides them tax returns and the opportunity to go into at an earlier stage and potentially reap benefits if the company thrives.

However, for investors open up to the risks entailed, backing startups can cause gains. Much of today's tech firms such as Facebook, Uber and Airbnb originated as early-stage start-ups sustained by approved angel capitalists. Sophisticated financiers have the chance to discover investment alternatives that might produce more earnings than what public markets supply

Unparalleled Accredited Investor Syndication Deals

Although returns are not guaranteed, diversity and profile improvement options are increased for capitalists. By diversifying their profiles through these increased financial investment methods recognized financiers can boost their techniques and potentially attain remarkable long-term returns with appropriate danger administration. Experienced capitalists frequently come across investment choices that may not be conveniently readily available to the general capitalist.

Investment choices and securities used to certified capitalists typically entail greater dangers. For instance, personal equity, equity capital and hedge funds frequently focus on purchasing possessions that bring threat but can be sold off quickly for the opportunity of greater returns on those dangerous investments. Investigating prior to spending is essential these in scenarios.

Secure durations prevent capitalists from withdrawing funds for even more months and years on end. There is likewise far much less openness and regulatory oversight of personal funds contrasted to public markets. Financiers might have a hard time to accurately value private assets. When handling risks certified capitalists require to examine any exclusive investments and the fund supervisors involved.

Specialist Investment Platforms For Accredited Investors

This adjustment might extend certified capitalist condition to a variety of people. Permitting partners in dedicated relationships to incorporate their sources for common qualification as recognized financiers.

Enabling individuals with certain expert qualifications, such as Collection 7 or CFA, to certify as recognized capitalists. Producing additional requirements such as evidence of monetary literacy or efficiently completing a recognized financier exam.

On the other hand, it might additionally result in seasoned capitalists thinking too much risks that might not be ideal for them. Existing recognized investors might deal with increased competition for the finest financial investment chances if the pool expands.

Superior Private Equity For Accredited Investors

Those that are presently considered accredited investors have to stay updated on any alterations to the requirements and laws. Their eligibility could be subject to modifications in the future. To maintain their status as certified investors under a modified definition changes might be essential in riches management techniques. Organizations looking for recognized capitalists should stay attentive about these updates to guarantee they are drawing in the appropriate audience of investors.

Table of Contents

- – Unmatched Accredited Investor High Return Inve...

- – Preferred Accredited Investor Real Estate Inve...

- – Optimized High Yield Investment Opportunities...

- – All-In-One Accredited Investor Passive Income...

- – Unparalleled Accredited Investor Syndication...

- – Specialist Investment Platforms For Accredit...

- – Superior Private Equity For Accredited Inves...

Latest Posts

Foreclosure Tax Sale

Tax Foreclosure Properties For Sale

Delinquent Homes

More

Latest Posts

Foreclosure Tax Sale

Tax Foreclosure Properties For Sale

Delinquent Homes